Gold remains the secret of Canada’s savviest investors. It sits outside the regular confines of the stock market and just waits it out while the market shoots up and down every week, and savvy investors know that since gold is not tied to a paper standard it is far more reliable than any other investment. Experts project that in total there is approx. 155,244 tons of gold on earth, with 52,000 tons of it yet to be mined. This means that a number of gold mines are being constructed today that will, when up and running, flood the market with gold and decrease its price. Indeed, new mines are popping up in India and Brazil to extract what is left of the world’s most precious metal.

There are a lot of options for those interested to buy gold in Toronto and all it takes is a minimum investment amount of $1,000 – after that, the sky’s the limit. So what are the benefits of investing in this finite resource?

Excellent Value

The 155,244 tons of gold represent a total value of $950bn. This is an astronomic figure, especially for a natural resource with few practical uses as gold. Of course, it is the lack of practical use that makes gold so valuable. On the one hand it means that very little of it will be melted down and used to build tables or to encrust a picture frame. On the other hand, gold has excellent value because it is one of the world’s oldest and most cherished aesthetic beauties. Much like the diamond trade, trading in gold is to deal with one of nature’s most exquisite beauties.

Long-term Staying Power

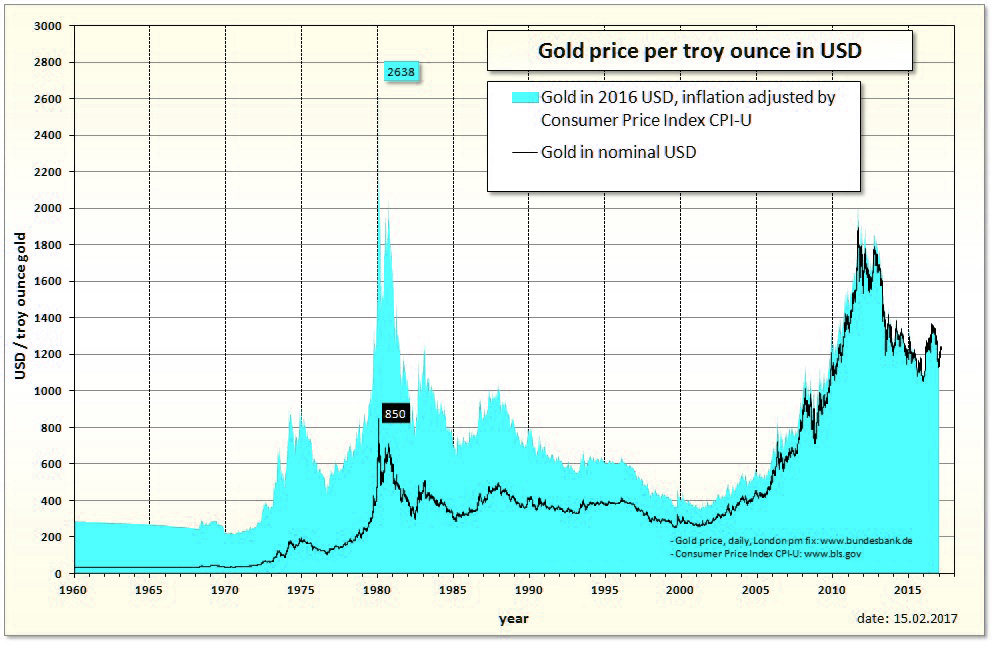

The key to understanding the benefits of gold as an investment is to think of it as a protective layer over the entire portfolio. What is the gold protecting? The volatility of the stock market, of course. Stocks, bonds, real estate, and any other investments made in the stock market are liable to fluctuate wildly because of inflation, due to a devalued currency. Gold is not tied to the paper standard and will not fluctuate wildly. The logic of savvy investors is to consistently buy gold whenever possible and watch its value rise. Gold will not move gradually down or gradually up in slow movements of 5-15 years, so there is no need to check the prices every morning and starting counting pennies.

High Interest Rates Are Bad For Gold Prices

Gold prices will rise when interest rates are kept low. In America, the reason why gold has been doing so well since the turn of the century has to do with federal monetary policy. The federal government has continued deficit spending for the past few years, meaning they are spending more than they are making. For example, the 2018 fiscal year saw the government spend $4.268 trillion when they only made $3.916 trillion. That’s a difference of $352 billion.

In combination with deficit spending, the Federal Reserve has kept interest rates low. The current interest rate sits at 1%. Taken together, these two macro-economic forces mean that the price of gold flourishes.

So, in summary, it’s a good time to invest in gold – savvy investors know it, and now you do too.