Forex trading is a trade where one currency is exchanged for another. It is similar to the concept of stock trading, with the only difference being that while in a stock trading, the commodities being traded are stocks, shares, debentures and other financial instruments; forex trading involves the trade of currencies. Today, forex trading is a major form of financial investment across the world. It is used for the purpose of both creating as well as preserving one’s wealth. This trend can only be expected to increase with the rise in awareness about finance and economy by the common man. There has in fact been a tremendous increase in the number of people getting involved with forex trading over the years.

These trends are a great development compared to before when people had zero awareness about finance and were financially illiterate. However, in addition to knowing about forex trading, it is also necessary to know about the different strategies that one can use while trading. While there is no dearth of strategies, it is necessary to know about as many as possible since each of them provides a unique way to get the greatest benefit out of each investment. Every single strategy is designed to help one navigate through different economic conditions, market situations and other issues with different currencies. Here are some of the forex trading strategies that work:

1.) RSI Stochastic Divergence Strategy This is a market trend analysis based on the Stochastic Divergence Strategy and the Relative Strength Index or RSI. It is used for the purpose of identifying the best trading opportunities, based on multiple technical indicators. It starts with Stochastic Divergence Strategy after which RSI is used for the purpose of confirming earlier inferences.

2.) Forex News Trading Strategy This is a strategy based on the comparison of the news forecasts with the actual changes. Based on these changes, the trends are calculated and a trading decision is taken.

3.) Nicolas Darvas Trading System This is a stock trading strategy that was developed by Nicolas Darvas in the late 1950s. It was designed to make trading decisions when there was very little time available. Nicolas Darvas was a highly paid dancer. He was on a world tour, where he was dancing before huge crowds. During the time when he wasn’t dancing, he was busy trading on the stock market, using nothing more than some research in Barron’s weekly news paper and using telegrams to keep in touch with his broker. This was so effective that Darvas was able to turn a $36,000 investment into more than $2.25 million during a three year period.

4.) Elliott Wave Theory with Fibonacci Retracement Levels Elliott Wave Theory with Fibonacci Retracement Levels is a trading strategy which uses a combination of Elliot Wave Theory and Fibonacci Ratios. Elliot wave principle is a form of technical analysis which is used by finance traders to analyze financial market cycles and forecast market trends. This is done through the identification of extremes in an investor’s psychology, the highs and lows in prices and other such related factors. Fibonacci retracement is a tool used by traders to predict market trends based on the Fibonacci number sequence.

5.) Bollinger Bands & Stochastic Strategy This is yet another hybrid trading strategy that employs Bollinger Bands and Stochastic Strategy. Bollinger Bands were developed by the famous trader John Bollinger and calculates trends based on two standard deviations from a simple moving average. Stochastics on the other hand is a tool used to analyze the relationship between the closing price and its price range over an extended period of time.

6.) Renko Charts Trading Strategy This trading strategy utilizes the study of Renko Charts for analysis. Renko charts are charts developed by the Japanese, which is only concerned with the price fluctuations and movements. It doesn’t take into consideration time or volume.

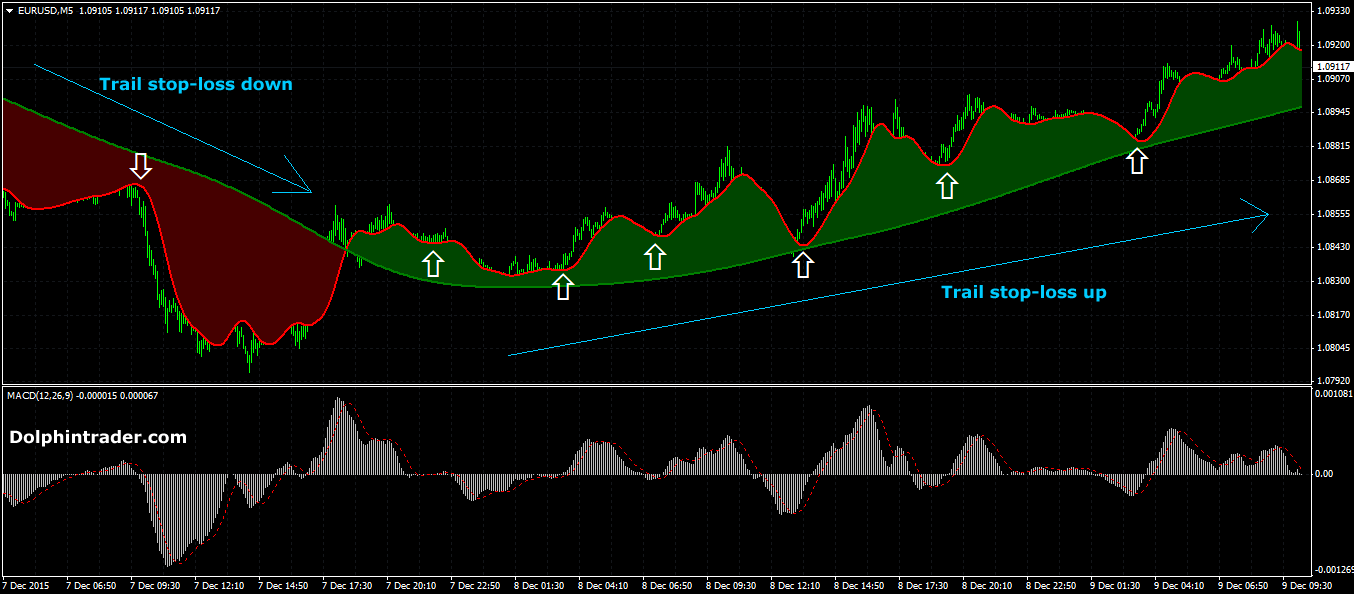

7.) Ichimoku and MACD Momentum Strategy This is a hybrid strategy from Japan. The strategy employs the usage of the trading indicator Ichimoku Cloud and the MACD analysis.

8.) 5 min Forex Scalping Strategy with Parabolic SAR and MACD This is also a hybrid trading strategy, which can be used by both full time as well as part time traders. The Parabolic SAR indicator is useful in measuring both momentum as well as trends, especially short term ones. The MACD indicator is used to confirm the analysis inference.

9.) 4 Hour RSI Bollinger Bands Strategy This is a strategy that was designed for people who didn’t want to stay in front of a screen all day. The strategy works on a combination of two principles; Bollinger Bands and Relative Strength Index (RSI). The combination of these two principles enables one to find out the market trends as well as estimate the profit or loss one will likely make.

10.) 1 Minute Forex Scalping Strategy with CCI and Slope Indicator This is a hybrid trading strategy that is used for making decisions very quickly through rapid inferences of trends. CCI stands for Commodity Channel Indicator. It is used to identify the peaks and valleys in an asset’s price. Slope indicators on the other hand deals with charting the direction that the price of an asset is heading, i.e. whether it is increasing or not. In all, while there are certainly plenty of strategies that one can use for making it in the forex trading world, the ultimate decision will be up to the trader. The decision will have to be taken on a wide variety of factors like finance, time, resources, market trends, currency, etc. Done right, it should pay off very well to the trader in both the short and the long run.